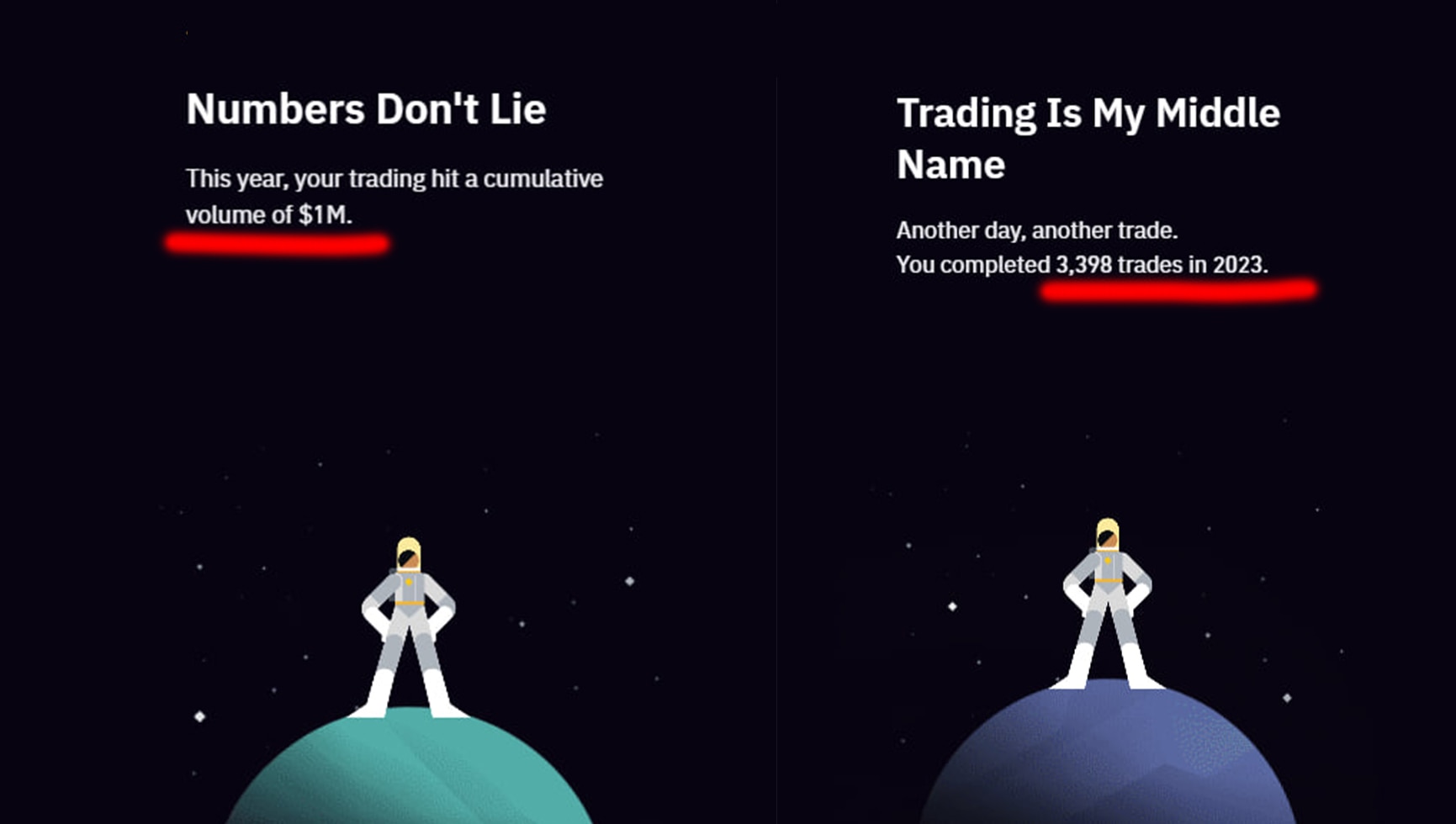

Did you ever have a year with a massive number of trades & trading volume but with little to no profit ?

In the realm of financial markets, High Frequency Trading (HFT) has gained prominence for its rapid execution of numerous trades within milliseconds.

However, a notable concern arises as the focus on speed and frequency may not necessarily translate into substantial profits for individual users. Instead, what often happens is a scenario where HFT contributes significantly to the generation of fees for the market.

The high volume of trades executed by HFT algorithms results in increased transaction fees, which can, in turn, have a substantial impact on the overall profitability of traders.

While HFT has the potential to enhance market liquidity, its intricate strategies may not always align with the financial gains of individual investors, making it imperative for traders to carefully evaluate the cost implications, including fees, associated with engaging in high-frequency trading activities.

Did you ever see something similar to this .. if the answer is “yes” you are not alone!

Reducing trading fees is a common goal for many traders, as high fees can eat into profits. Here are some strategies to consider:

- Use Fee-Free Platforms:

- Some trading platforms offer fee-free trading or reduced fees for certain transactions. Look for platforms that provide favorable fee structures.

- Leverage Maker Orders:

- Many exchanges distinguish between market makers and market takers. Market makers provide liquidity by placing limit orders that are not immediately matched with existing orders. Some exchanges offer lower fees or rebates for market makers. By placing limit orders on the order book, you may be able to reduce your trading fees.

- Take Advantage of Fee Rebates:

- Some exchanges offer fee rebates for high-volume traders. By trading in larger volumes, you may qualify for lower fees or even rebates. Be sure to check the fee structure of the exchange you’re using.

- Use Fee Tier Discounts:

- Some exchanges have tiered fee structures, where fees decrease as your trading volume increases. Consider consolidating your trades to reach higher trading volume tiers and benefit from lower fees.

- Consider Over-the-Counter (OTC) Trading:

- OTC trading involves executing large trades directly with a counterparty, bypassing the open market. OTC trades may have negotiated fees and can be more cost-effective for large transactions.

- Explore Decentralized Exchanges (DEX):

- DEXs operate on blockchain technology and allow users to trade directly from their wallets. Some DEXs have lower fees compared to traditional centralized exchanges. However, liquidity may be a concern on certain DEXs.

- Hold Positions for the Long Term:

- By adopting a long-term investment strategy, you can reduce the frequency of your trades, thereby minimizing the impact of fees. This strategy is often associated with a “buy and hold” approach.

- Monitor Fee Changes:

- Keep an eye on the fee structure of the exchange you’re using, as exchanges can sometimes adjust their fee schedules. Stay informed about any changes that may affect your trading costs.

It’s important to note that while reducing fees is important, it shouldn’t be the sole focus. Consider other factors like liquidity, security, and the overall trading experience when selecting a platform or implementing trading strategies. Additionally, be aware that some strategies involve trade-offs and may carry their own risks. Always conduct thorough research and, if possible, seek advice from financial professionals.

In the end, I would like to add a couple of notes:

- If you are making lots of trades and trading volume but have little to no profits, *you* are the liquidity provider and you just don’t know it yet.

- All Trading is Speculative, Dangerous and may lead to Losses and Liquidations.